In a fast-paced world of financial markets, navigating the realm of investment strategies can feel like embarking on a daunting adventure. Enter ETF funds – a versatile and efficient tool for savvy investors looking to tap into the Indian market. With a myriad of options to choose from, finding the right ETF fund in India can be a game-changer for your portfolio. Let’s delve into the world of investing strategies with ETF funds in India, and unlock the door to potential growth and prosperity.

Exploring the Best ETFs for Investing in the Indian Market

When it comes to investing in the Indian market, Exchange-Traded Funds (ETFs) can be a great option for diversifying your portfolio and gaining exposure to various sectors of the economy. With the Indian economy growing at a rapid pace, there are plenty of opportunities for investors to capitalize on. By choosing the right ETFs, you can take advantage of this growth and maximize your returns.

Some of the best ETFs for investing in the Indian market include:

- ICICI Prudential Sensex ETF: This ETF tracks the performance of the Sensex index, which includes some of the largest and most established companies in India.

- HDFC Bank Nifty 50 ETF: This ETF mirrors the Nifty 50 index, providing exposure to the top 50 companies listed on the National Stock Exchange of India.

- UTI Nifty ETF: Another fund that tracks the Nifty 50 index, offering investors a way to invest in a diverse range of sectors and industries in the Indian market.

Key Considerations When Choosing ETF Funds in India

When selecting ETF funds in India, it is crucial to consider a few key factors to ensure a successful investment strategy. One important consideration is the expense ratio of the ETF, as this will impact your overall returns. Look for ETFs with low expense ratios to maximize your profits over time. Additionally, assess the liquidity of the ETF as it can affect your ability to buy and sell shares without significant price fluctuations.

Another critical aspect to evaluate is the tracking error of the ETF. A low tracking error indicates that the ETF closely follows its underlying index, which is essential for achieving your investment goals. Furthermore, consider the performance history of the ETF to determine its consistency and reliability. By carefully examining these factors, you can make informed decisions and build a strong ETF portfolio in India.

Diversification Strategies for Optimal Returns

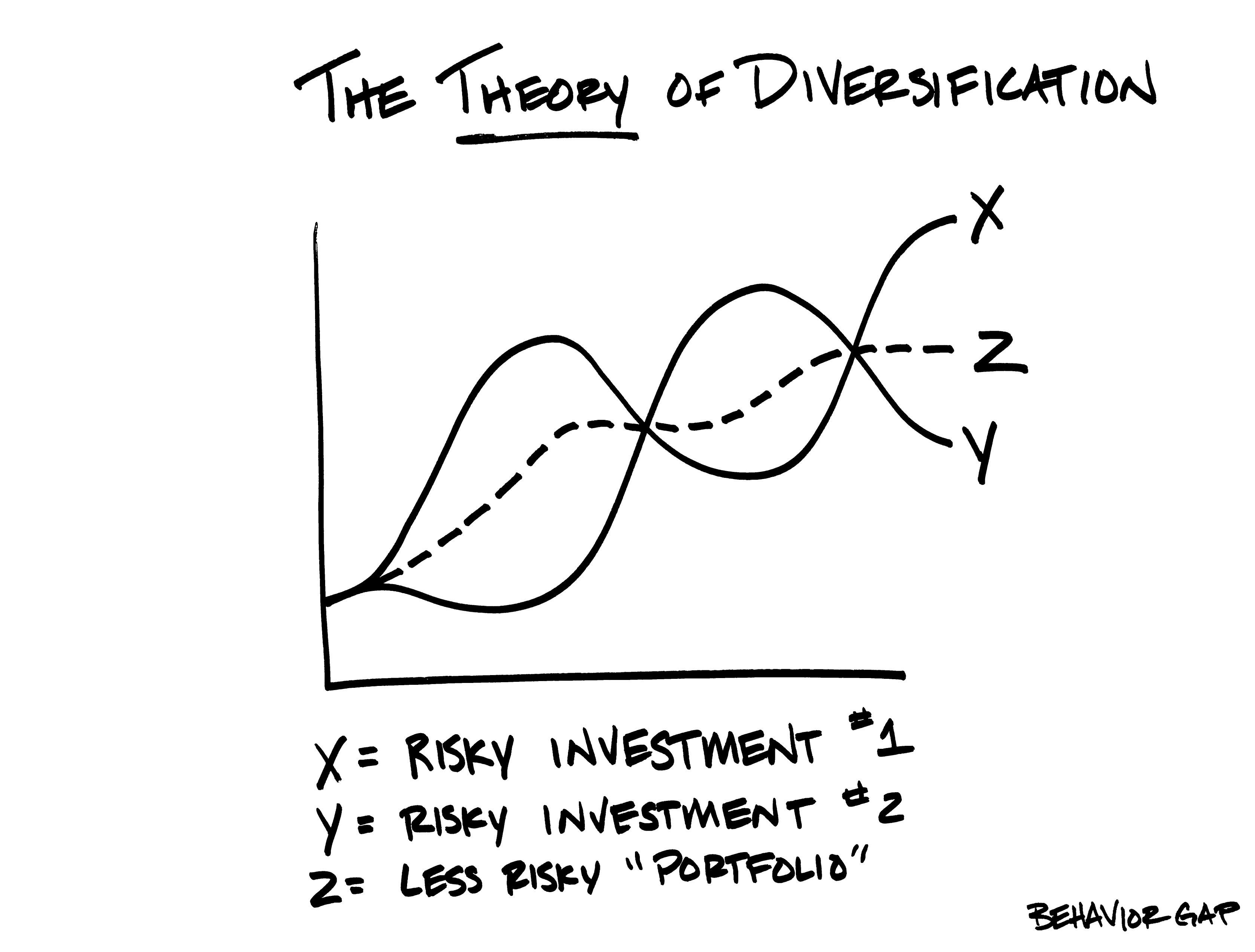

When it comes to investing in ETF funds in India, diversification is key to achieving optimal returns. By spreading out your investments across different asset classes, sectors, and geographical regions, you can reduce risk and maximize potential gains. One strategy is to invest in a mix of equity, fixed income, and commodity ETFs to ensure a balanced portfolio. Another approach is to focus on specific sectors or themes that you believe will outperform the market in the long run.

Furthermore, consider investing in ETFs that track different indices to diversify your exposure to different markets. For example, you can invest in ETFs that track the Nifty 50, Sensex, or other benchmark indices. Additionally, consider incorporating international ETFs into your portfolio to gain exposure to global markets and currencies. By adopting a diversified approach to investing in ETF funds in India, you can increase your chances of generating optimal returns over time.

Recommended ETF Funds for Long-term Growth in the Indian Market

When looking for ETF funds for long-term growth in the Indian market, it’s important to consider a well-diversified portfolio that can withstand market fluctuations. One recommended ETF fund is the Nifty 50 ETF, which tracks the performance of the 50 largest and most liquid Indian companies listed on the National Stock Exchange. This fund provides exposure to various sectors such as finance, consumer goods, technology, and energy, making it a solid choice for long-term growth.

Another promising ETF fund for long-term growth in the Indian market is the S&P BSE Sensex ETF, which tracks the performance of the 30 largest and most actively traded stocks on the Bombay Stock Exchange. This fund offers exposure to blue-chip companies in India across different industries, providing investors with a well-rounded portfolio for sustainable growth over time.

As we wrap up our exploration of investing strategies in ETF funds in India, we hope you have gained valuable insights into this dynamic and increasingly popular investment avenue. Remember, success in investing requires careful research, sound decision-making, and a long-term perspective. Whether you are a seasoned investor or just starting out, ETF funds offer a convenient and diversified way to grow your wealth. So, keep learning, stay informed, and happy investing!