Sensex Symphony: Harmonizing Profitable Investments

Introduction

Investing in the stock market can be a daunting task for many individuals. With the ever-changing landscape of the global economy, it’s crucial to have a solid understanding of how to navigate the world of investments. The Sensex, often referred to as the benchmark index of the Bombay Stock Exchange (BSE), is a key indicator of the performance of the Indian stock market. Whether you’re a seasoned investor or just starting out, learning how to harmonize your investments with the Sensex can lead to profitable outcomes.

Understanding the Sensex

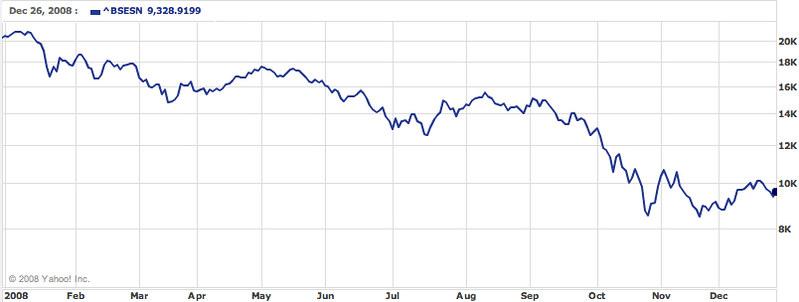

The Sensex is a weighted index of the top 30 companies listed on the BSE. These companies represent various sectors such as banking, IT, energy, and consumer goods. The index reflects the overall performance of these companies and serves as a barometer for the Indian stock market. By tracking the Sensex, investors can gain insights into the market trends and make informed decisions about their investments.

Benefits of Investing in the Sensex

– Diversification: The Sensex consists of companies from different sectors, providing investors with a diversified portfolio.

– Market Performance: As a benchmark index, the Sensex reflects the overall performance of the Indian stock market.

– Long-term Growth: Historically, the Sensex has shown steady growth over the years, making it an attractive investment option.

– Liquidity: The Sensex comprises highly liquid stocks, making it easier for investors to buy and sell shares.

– Transparency: The Sensex is widely followed by investors and analysts, providing transparency in market movements.

Harmonizing Your Investments with the Sensex

To maximize your investment returns and align them with the performance of the Sensex, consider the following strategies:

1. Research and Analysis

Before making any investment decisions, conduct thorough research and analysis of the companies listed on the Sensex. Understand their financial performance, market position, and future prospects to make informed investment choices.

2. Diversification

Diversifying your investments across different sectors and asset classes can help reduce risk and improve returns. Invest in a mix of Sensex stocks, mutual funds, and other financial instruments to create a well-rounded portfolio.

3. Risk Management

Evaluate the risk appetite and time horizon of your investments. Consider using tools like stop-loss orders and hedging strategies to protect your portfolio from market volatility.

4. Stay Informed

Keep abreast of the latest market developments, economic indicators, and corporate news that may impact the performance of the Sensex. Stay connected with financial experts and analysts to stay ahead of market trends.

Practical Tips for Investing in the Sensex

– Set clear investment goals and a structured investment plan.

– Monitor your investments regularly and rebalance your portfolio as needed.

– Consider investing in SIPs (Systematic Investment Plans) for disciplined and regular investing.

- Seek professional guidance from financial advisors for personalized investment advice.

Conclusion

Harmonizing your investments with the Sensex can lead to profitable outcomes and long-term financial success. By understanding the dynamics of the stock market, diversifying your portfolio, and staying informed about market trends, you can navigate the world of investments with confidence. Remember to conduct thorough research, manage risks effectively, and seek professional guidance when needed. Happy investing!