In the fast-paced world of stock trading, intraday trading stands as a strategic playground for those seeking quick profits in the fluctuations of the market. With traders constantly buying and selling securities within the same trading day, the stakes are high and the adrenaline is addicting. Dive into the world of intraday trading, where split-second decisions can make all the difference between a financial win and a devastating loss.

Understanding the Basics of Intraday Trading

Intraday trading refers to the buying and selling of stocks within the same trading day. This type of trading requires a good understanding of market trends and the ability to make quick decisions. One of the main advantages of intraday trading is the potential for high returns in a short period of time, but it also comes with increased risk due to the volatile nature of the stock market.

Successful intraday traders often rely on technical analysis to predict price movements and make informed decisions. It’s important to have a well-thought-out trading strategy and to stick to it, avoiding emotional decision-making. Intraday trading can be a challenging but rewarding endeavor for those who are willing to put in the time and effort to learn the basics and develop their skills.

Effective Strategies for Maximizing Profits in Intraday Trading

When it comes to maximizing profits in intraday trading, there are several effective strategies that traders can implement to increase their chances of success. One key strategy is **setting realistic profit targets**. By establishing clear profit goals for each trade, traders can avoid getting greedy and making impulsive decisions that can lead to losses.

Another effective strategy is **managing risk effectively**. This involves carefully managing stop-loss orders to limit potential losses and protect profits. Additionally, diversifying your portfolio and **keeping a close eye on market trends** can help you identify profitable opportunities and make informed trading decisions.

Risk Management Techniques for Successful Intraday Trading

When it comes to intraday trading, implementing effective risk management techniques is crucial for maximizing profits and minimizing losses. One key strategy is setting stop-loss orders to limit potential losses on trades. By defining the maximum amount of money you are willing to lose on a trade, you can protect your capital and prevent emotional decision-making.

Another important risk management technique for successful intraday trading is diversification. By spreading your investments across different asset classes or sectors, you can reduce the impact of any single trade on your overall portfolio. Additionally, using technical analysis tools such as moving averages or Fibonacci retracement levels can help you identify entry and exit points with higher probability of success.

Utilizing Technical Analysis Tools for Intraday Trading Success

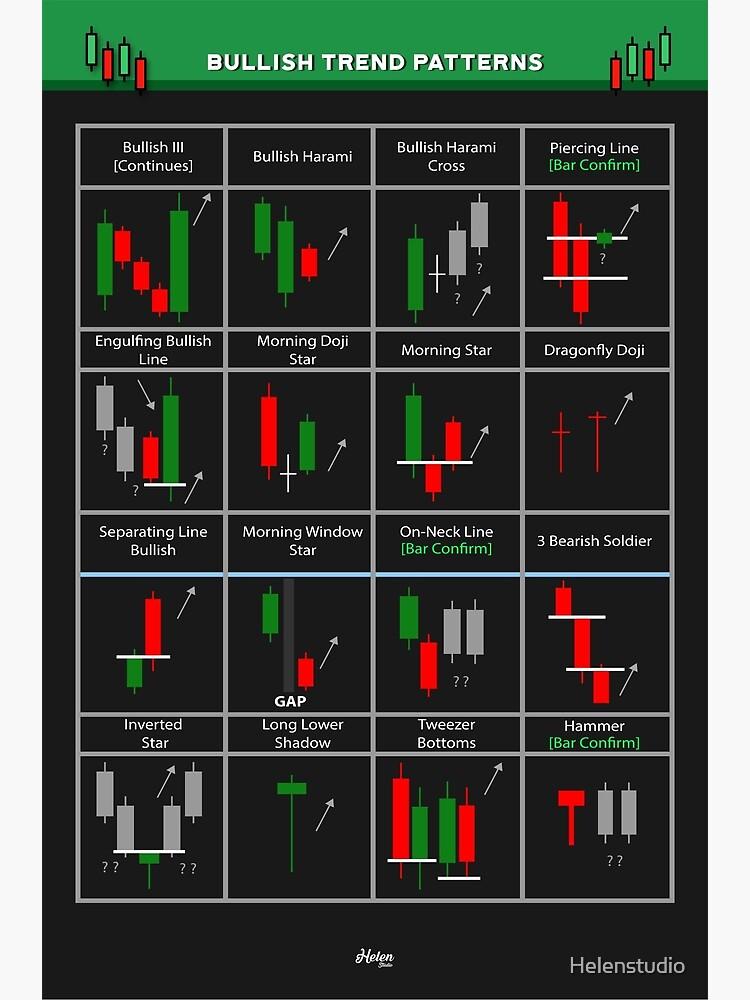

When it comes to successfully navigating the fast-paced world of intraday trading, utilizing technical analysis tools is key. These tools are essential for traders looking to make informed decisions based on market trends and patterns. By leveraging technical analysis tools, traders can identify entry and exit points, set stop-loss orders, and maximize their profit potential.

Some of the most commonly used technical analysis tools for intraday trading include:

- Moving averages: Helps identify trends and potential reversal points.

- RSI (Relative Strength Index): Indicates overbought or oversold conditions in the market.

- Bollinger Bands: Shows volatility and potential price breakouts.

In conclusion, intraday trading is a fast-paced and exciting way to participate in the financial markets. While it can be profitable for some, it also carries a high level of risk and requires careful planning and strategy. Whether you’re a seasoned trader or just starting out, always remember to stay informed, stay disciplined, and stay focused on your goals. Happy trading!